Most people don’t realize how much their prescription drug coverage can vary - until they show up at the pharmacy and get hit with a bill they never saw coming. One person’s $10 copay for insulin could be another person’s $300 out-of-pocket cost. That’s not a mistake. It’s how insurance works when you don’t ask the right questions.

Is My Medication Even Covered?

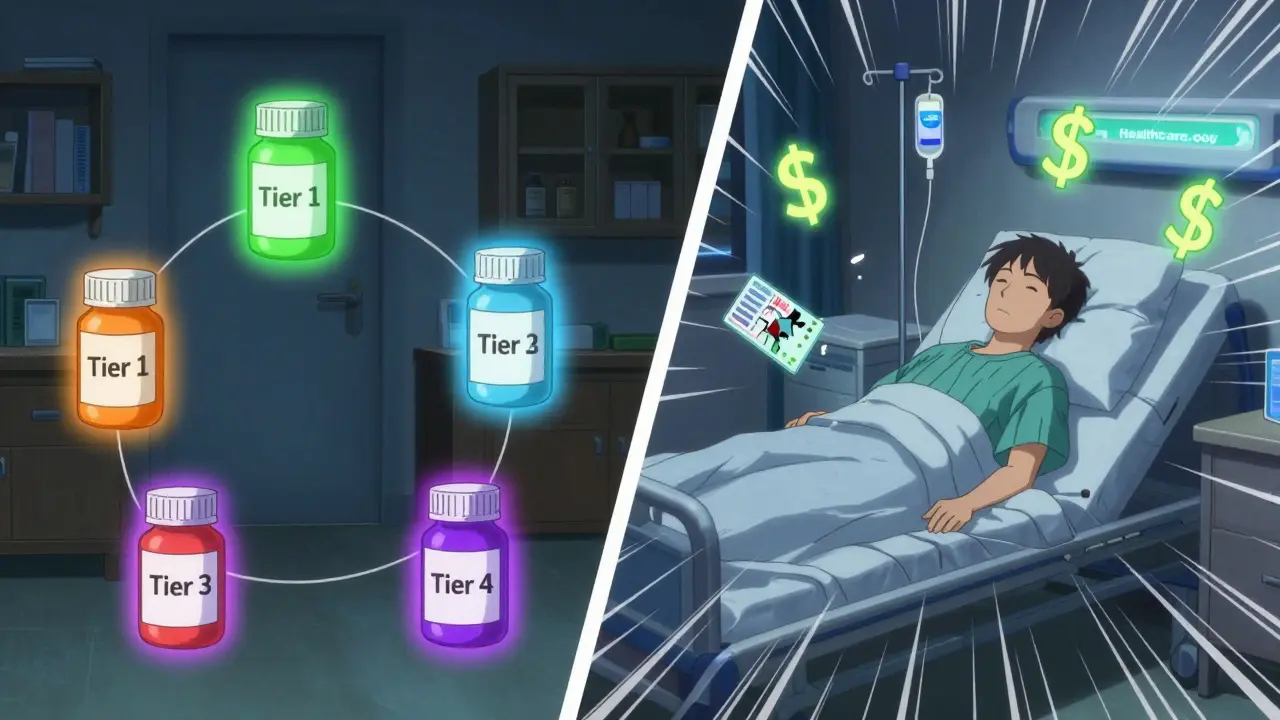

The biggest mistake people make? Assuming their meds are covered. Insurance plans don’t cover every drug. They use something called a formulary - a list of approved medications grouped into tiers. If your drug isn’t on the list, you pay full price. No exceptions. Start by listing every medication you take regularly. Include generics and brand names. Then check your plan’s formulary. Don’t just look at the name. Look at the exact dosage. A 10mg tablet might be covered, but the 20mg version isn’t. That’s common. Medicare Part D and Marketplace plans both use formularies. Some plans even have different formularies for different pharmacy networks. If you use a specific pharmacy, make sure your meds are covered there. Out-of-network pharmacies can charge 37% more - and your plan might not cover it at all.What Tier Is My Drug On?

Formularies are split into four tiers. Each tier has a different price. Here’s what that looks like in real dollars:- Tier 1 (Generic): Around $10 copay. These are the cheapest, most commonly covered.

- Tier 2 (Preferred Brand): Around $40 copay. Brand-name drugs your plan prefers.

- Tier 3 (Non-Preferred Brand): Around $100 copay. These are expensive brands your plan doesn’t push.

- Tier 4 (Specialty): 25-33% coinsurance. For drugs like biologics, cancer treatments, or rare disease meds. Costs can hit $1,000+ per prescription.

What’s My Deductible?

Some plans make you pay the full cost of your meds until you hit a deductible. Bronze Marketplace plans average a $6,000 deductible. That means if you take three prescriptions a month, you could pay $1,500 out of pocket before your insurance kicks in. Gold and Platinum plans have much lower deductibles - sometimes as low as $150. If you’re on regular meds, paying a higher monthly premium might save you thousands. CMS found that someone filling 12 maintenance drugs a year saves $1,842 on a Gold plan versus a Bronze one. That’s not a small difference. It’s life-changing.Do I Need Prior Authorization?

Some drugs require your doctor to jump through hoops before your plan will pay. This is called prior authorization. It’s required for 28% of Medicare Part D prescriptions. That means your doctor has to submit paperwork, maybe even prove you tried cheaper alternatives first. If your plan requires prior authorization for your drug, ask: How long does it take? What happens if it’s denied? Can your doctor appeal? One person on Reddit lost a month of treatment because their insurer denied authorization for their thyroid med. They didn’t know they could appeal - until they ran out.What’s Step Therapy?

Step therapy means you have to try cheaper drugs before your plan will cover the one your doctor prescribed. For 37% of specialty drugs in Marketplace plans, this rule applies. Say your doctor prescribes a new biologic for psoriasis. Your plan says, “Try this generic first.” But that generic doesn’t work for you. You’re stuck paying out of pocket for months while you fight the system. Ask your plan: “Which of my drugs require step therapy?” Then ask your doctor: “Can you write a letter to bypass this?” Many doctors know how to do it.

Is There a Coverage Gap?

If you’re on Medicare Part D, you’ve probably heard of the “donut hole.” That’s the gap between what you and your plan pay. In 2024, you hit the gap after spending $5,030 on drugs. You pay 25% of costs until you hit $8,000. Then catastrophic coverage kicks in. But here’s the big change: Starting in 2025, the donut hole is gone. You’ll pay 25% of costs all year. And insulin? It’s capped at $35 per month. That’s huge. If you’re on Medicare, this is the most important update in 20 years.What’s the Out-of-Pocket Maximum?

Every plan has a cap on what you pay in a year. After you hit it, your plan pays 100% for covered drugs. Bronze plans have a $9,450 cap. Platinum plans? $3,050. If you’re on expensive meds, that cap matters more than your monthly premium. A woman in Ohio switched from a Bronze to a Gold plan after her specialty drug bill hit $7,200 in one year. Her premium went up $200 a month. But her annual out-of-pocket dropped from $9,000 to $4,100. She saved $4,900. That’s not a trade-off. That’s a win.Can I Switch Plans?

You can’t switch anytime. There are windows. For Marketplace plans: Open Enrollment runs from November 1 to January 15. Use the HealthCare.gov tool. Enter your exact meds and pharmacy. It shows you which plans cover them and how much you’ll pay. For Medicare: The Annual Election Period is October 15 to December 7. Use Medicare Plan Finder. Enter your drugs by NDC code (it’s on the bottle). Don’t guess. Use the code. 32% of Medicare beneficiaries changed plans in 2023 because they didn’t check coverage early enough.What About Pharmacy Networks?

78% of Marketplace plans restrict you to certain pharmacies. If your go-to pharmacy isn’t in-network, you pay more - or nothing at all. CVS, Walgreens, and Walmart are common in-network. But local pharmacies? Not always. Ask: “Which pharmacies are in-network?” Then call your pharmacy and ask if they accept your plan. Don’t assume. One man in Texas drove 40 miles to a chain pharmacy because his local one didn’t accept his plan. He didn’t know until he got there - and his prescription was $200 more.

What’s Changing in 2025?

The Inflation Reduction Act is changing everything for Medicare users. By 2025:- Insulin will cost no more than $35 per month.

- You’ll pay no more than $2,000 out of pocket for all prescriptions.

- The donut hole disappears.

What If My Drug Isn’t Covered?

If your drug isn’t on the formulary, you have options:- Ask your doctor for a generic alternative.

- Request a formulary exception. Your doctor can submit a letter explaining why you need it.

- Check if the manufacturer offers a patient assistance program. Many do.

- Switch plans during open enrollment.

How Much Time Should I Spend?

People who spend 20 minutes checking their drug coverage save $1,147 a year on average. That’s more than a month’s worth of copays. It’s worth it. Set aside 30 minutes during open enrollment. Write down your meds. Know your doses. Call your pharmacy. Use the tools. Don’t wait until you’re at the counter, staring at a bill you can’t afford.Final Thought

Prescription drug coverage isn’t about having insurance. It’s about having the right insurance. You can have the best plan in the world - but if your drug isn’t covered, it’s useless. Ask the questions. Check the details. Don’t trust assumptions. Your health depends on it.Do all health plans cover prescription drugs?

Yes, all Marketplace plans under the Affordable Care Act must include prescription drug coverage. Medicare Part D also covers drugs. But employer plans vary - though 85% include them. Always confirm your specific drugs are covered, even if the plan says it includes prescriptions.

What if my drug is on the formulary but still too expensive?

You might be in a higher tier or subject to step therapy. Ask your plan for a tier exception or formulary exception. Your doctor can help. You can also check for manufacturer coupons or patient assistance programs. Some drugmakers offer free meds to low-income patients.

Can I use a mail-order pharmacy to save money?

Many plans offer discounts for 90-day supplies through mail-order pharmacies. For maintenance drugs like blood pressure or diabetes meds, this can cut your monthly cost in half. Check if your plan offers it and if your meds are eligible. Some plans require you to use mail-order after the first 30-day fill.

Why does my plan cover a drug one year but not the next?

Formularies change every year. Plans can remove drugs, move them to higher tiers, or add prior authorization. Always review your plan’s formulary during open enrollment - even if you’re happy with your current plan. A small change can cost you hundreds.

What’s the difference between Medicare Part D and Medicare Advantage with drug coverage?

Medicare Part D is a standalone drug plan. Medicare Advantage (Part C) includes medical and drug coverage in one plan. Advantage plans often have lower premiums but tighter pharmacy networks - 68% use tiered networks versus 42% of standalone Part D plans. If you see a specialist or use a local pharmacy, Advantage might not work for you.

How do I find out if my drug is covered before I enroll?

Use the plan comparison tool on HealthCare.gov or Medicare.gov. Enter your exact medications and pharmacy. The tool shows you which plans cover them and your estimated costs. Don’t rely on sales reps or brochures. Use the tool. It’s free and accurate.

Are there any new laws helping with drug costs?

Yes. Starting in 2025, Medicare Part D beneficiaries will pay no more than $2,000 a year out of pocket for all prescriptions. Insulin will cost $35 per month. The coverage gap is gone. Also, Medicare will start negotiating prices for 20 high-cost drugs - which could lower premiums by 10-15% by 2030.

Should I choose a higher-premium plan if I take expensive meds?

Yes - if you take multiple maintenance drugs or a specialty medication. A Gold or Platinum plan with a lower deductible and out-of-pocket cap often saves more than a Bronze plan with a low premium. CMS found people on 12+ meds save $1,842 a year on Gold vs. Bronze. The higher premium pays for itself.